Life cycle cost (LCC) can be defined as the sum of the total cost of a product, service, or technology over its lifetime. For example, think of a car with an average life of eight years or 150,000 miles. The price quoted is only the initial cost of the car, not its running cost over eight years. To obtain this calculation you must add your car’s insurance, interest, gas, oil changes, preventive maintenance, and service over eight years, less its estimated trade in value to get the full picture of any car’s LCC.

How Is Life Cycle Cost Calculated?

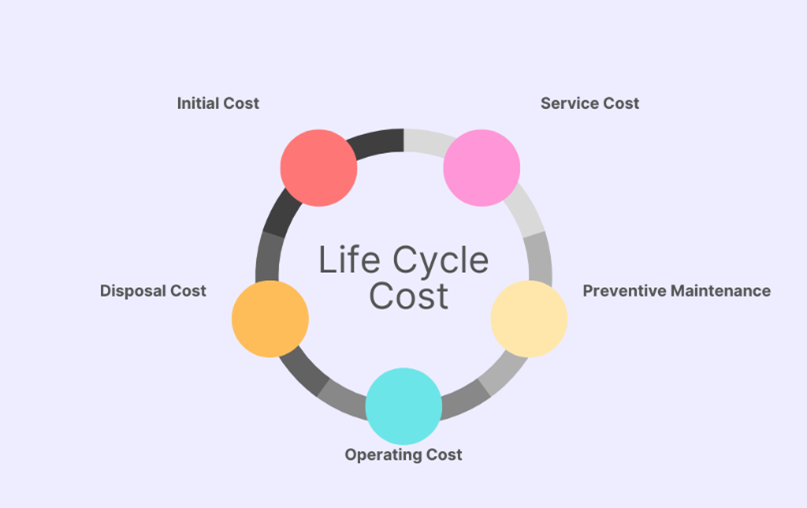

Similar to my car example, you add the initial and running costs (see figure 1) of the product, service, or technology under investigation over the estimated life of the commodity, then subtract the value left after its useful life.

Figure 1: Life Cycle Cost Elements

A good example of this concept is an IV infusion pump with an initial cost of $5,982 and a seven-year life (figure 2).

Figure 2: IV Infusion Pump LCC Example

| Estimated Life | 7 Years |

| Initial Cost | $5,982 |

| IV Set Cost | $300,000 |

| Service Cost | $1,000 |

| Preventive Maintenance | $700 |

| Operating Cost (Utilities, etc.) | $350 |

| Subtotal | $308,032 |

| Less Trade In Value | ($200) |

| Life Cycle Cost | $307,832 |

You will note after examining this calculation that the in-use cost of an IV infusion pump is 51 times ($308,032/$5,982) more than the initial cost of the IV pump. That’s why we preach that your savings job isn’t done when you obtain the best price for the commodity you are buying. It is just the tip of the iceberg! You need to drill down even deeper if you want to wring the towel dry on your life cycle cost savings.

What is Life Cycle Cost Analysis?

Life Cycle Cost Analysis (LCCA) is the assessment of the total cost of ownership (acquiring, owning, and disposal of a product, service, or technology) over its lifetime. The goal is to reduce operational cost, eliminate waste and inefficiencies, and increase the life span of the commodity. Going back to our IV infusion pump example, we often discover while performing LCCA for our clients wasteful and inefficient consumption, misuse, and misapplication of their IV sets that can represent as much as 50% of their life cycle cost. That’s why it is mission critical that LCCA is performed on every commodity with an annualized spend of $250,000+.

How to Integrate LCC with Your Value Analysis Model

Now that you understand the concept of LCC, how do you integrate it into your value analysis model? The answer is to measure your LCC outliers with a technique called Value Analysis Analytics (or the extensive use of data, statistical and quantitative analysis, explanatory, predictive models, and fact-based management*) on each commodity you purchase with an annualized spend of $250,000+ to determine the best candidates for LCCA. Then add one of these LCC outliers to your value analysis agenda each time your VA team meets. Then assign a VA Project Manager to perform the LCCA over a 90-day period and report back their results. You will be amazed at the results of the life cycle cost assessments.

(*) Definition by Thomas H. Davenport, Competing on Analytics

| About Robert T. Yokl, Founder & Chief Value Strategist for SVAH Solutions |

|---|

| Robert T. Yokl is President and Chief Value Strategist at SVAH Solutions. He has four decades of experience as a healthcare supply chain manager and consultant, and also is the co-creator of the Clinitrack Value Analysis Software and Utilizer Clinical Utilization Management Dashboard that moves beyond price for even deeper and broader clinical supply utilization savings. Yokl is a member of Bellwether League’s Bellwether Class of 2018. https://www.SVAH-Solutions.com https://www.SavingsValidator.com |

Articles you may like:

Why Group Purchasing Is Only One Side of the Savings Triangle Equation

How Utilization Reporting Helps You Pick Up Savings Opportunities Including Price